International instant transfers to be paid directly only in Burundi Francs

The Briefing Issue #59, Monday, March 16, 2020

Dear Readers

In a letter addressed to Burundi commercial banks this Monday, March 16, the Burundi Central Bank announced that international instant transfers must be paid directly only in local currency.

Beneficiaries can no longer collect remittances in foreign currency, including those who have accounts in dollars or Euro in commercial banks.

The Burundian central bank, Banque de la Republique Burundi (BRB), monitors international financial transfers that are made to and from Burundi through banks and MTOs (Money Transfer Operators).

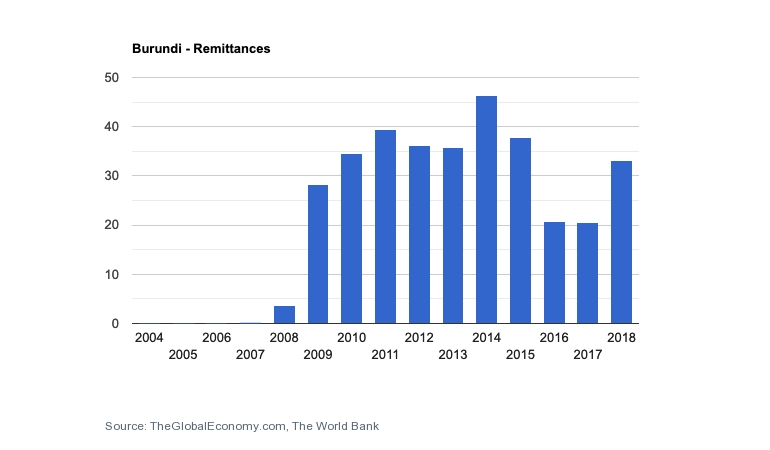

The World Bank provides data for Burundi Remittances from 2004 to 2018. The average value for Burundi during that period was 22.43 million U.S. dollars with a minimum of 0.01 million U.S. dollars in 2006 and a maximum of 46.42 million U.S. dollars in 2014. The latest value from 2018 is 33.07 million U.S. dollars.

For comparison, the world average in 2018 based on 131 countries is 3103559832.37 million U.S. dollars.

The main players on the remittances market in Burundi are commercial banks and MTOs such as Western Union, Moneygram, Money Contact and Travelex. The MTOs all operate within one or several of the commercial banks.

Western Union is the market leader among the MTOs in Burundi, currently working with 4 banks (BCB, Interbank, Ecobank, and Bancobu).

MTOs are present in Burundi since the early 2000s and have taken over the remittances market at a fast pace. The services of the MTOs are known to be fast and reliable.

Another advantage is that MTOs do not require a bank account, which is something that limits many people living in rural areas to receive financial transfers through banks. A disadvantage is that it is relatively expensive to use MTOs in Burundi

Sonja Fransen an Expert from Maastricht University who did research on the Emerging Remittances Market in Burundi notes that most of the remittances sent from abroad come from Europe and North America. Regional migration is taking place, especially to neighboring countries Rwanda and Tanzania

Remittance inflows to GDP (%) in Burundi were reported at 1.0607 % in 2017, according to the World Bank collection of development indicators, compiled from officially recognized sources.

According to AFDB, remittances constitute an increasingly significant flow of funds to the developing world. In 2004, remittances totaled more than USD 160 billion, an increase of over 65%since 2001, when their flows stood at an estimated USD 96.5 billion; the figures went up to US$300 billion during 2006, $328 billion in 2007 (IFAD, 2009), rising to $372 billion in2011 and to an estimated $406 billion in 2012 (World Bank, 2012).

Remittance flows to and within Africa are currently about US$40 billion. Countries in Northern Africa (for example, Morocco, Algeria, and Egypt) are the major recipients of remittances on the continent. Eastern African countries also depend heavily on these flows, with Somalia and Eritreastanding out as particularly the most remittance dependent.

For the entire continent, annual average remittances per migrant reached almost US$1,200 by the third quarter of 2012 and on a country-by-country average represent 5 percent of GDP and 27 percent of exports (IFAD, 2012).

What do you think about this Bank of the Republic of Burundi’s new measure?Let us know in the comment section or send an e-mail: editor@regionweek.com

Fabrice Iranzi

Editor, RegionWeek.com

-

RegionWeek is a Burundi-based media for a new generation of achievers in Africa, a platform devoted to chronicling the journey to Freedom and Empowerment.